5 Roadblocks to Affordable Homeownership (And Ways to Move Past Them)

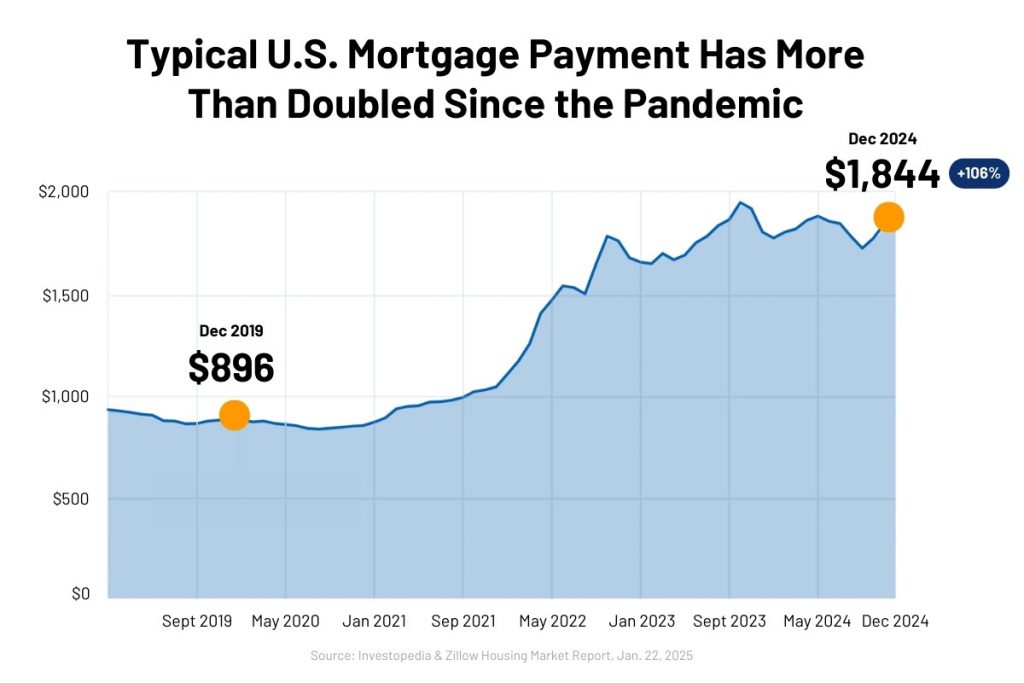

Dreaming of a new home but feeling priced out, especially in areas like Downers Grove, Woodridge, or Naperville?? You’re not alone! According to a recent survey by Bankrate, 78% of aspiring homebuyers cite affordability issues as their primary deterrent.1According to data from the U.S. Census Bureau, home prices have risen around 32% since the pandemic, and elevated mortgage rates have caused monthly payments to balloon.2Despite the challenges, homeownership remains a top goal for many Americans. Fortunately, there are ways to turn your dreams of homeownership into reality! In this guide, we’ll explore five common roadblocks to affordable homeownership and actionable solutions to help you overcome them. If you’re also planning to sell a home while buying, be sure to check out my post on 9 Tips for Buying and Selling Your Home at the Same Time for more helpful strategies. Let’s break down those barriers so you can finally get the home of your dreams!I’m Shanon Tully with Shanon Tully Real Estate at Platinum Partners Realtors, and I’ve worked with many homebuyers across Downers Grove and the surrounding suburbs who have faced these same challenges. With practical strategies and local insights, it’s absolutely possible to find a home that works for your lifestyle and budget. If you’re thinking about buying a home in the western suburbs of Chicago, I’d love to help you get started.

ROADBLOCK #1: I Don’t Have Enough Saved For A Down Payment

Many prospective buyers believe they need a 20% down payment to buy a home. But in reality, most conventional loans require just 3-5%. And, for buyers who qualify, there are a number of programs and mortgage options that can make a home purchase more accessible.

Down Payment Assistance Programs (DPAs)DPAs offer grants, loans, and other financial assistance to help with your down payment and closing costs. Many programs are specifically designed for first-time buyers, but there are also options for repeat homebuyers.³ ⁴ These programs can significantly reduce the upfront costs of buying a home. We can help you find down payment assistance programs. Contact us to find out more!

0% Down Government – Backed MortgagesIf you qualify for certain government-backed mortgages, you may not need to come up with a down payment at all.⁵ While these loans, offered by the Department of Veterans Affairs (VA) and the United States Department of Agriculture (USDA), are not available to all buyers, they offer numerous benefits, including competitive rates and no down payment requirement.

VA loans are available to U.S. military members, including veterans and surviving spouses.⁶ They do not require a down payment, though the buyer must pay a fee at closing.

USDA loans are available to moderate to low-income buyers in certain rural areas.⁷ They do not require a down payment.

Family Gifts

Did you know that 25% of first-time buyers in 2024 reported receiving down payment gifts or loans from family members or friends?⁸ In fact, a growing number of Baby Boomers are choosing to gift all or a portion of their heirs’ inheritance before they pass away.⁹ Some financial advisors even recommend this as part of their client’s estate plan. Just be sure to follow the proper procedures to document these types of gifts, if you’re fortunate enough to receive them.¹⁰

This trend is becoming more common among homebuyers in Downers Grove, Clarendon Hills, and Hinsdale as families look for smart ways to support the next generation.

Existing Home Equity Due to record-high real estate gains over the past few years, if you already own a home, you may have more equity than you realize.¹¹ This equity (or difference between your home’s current value and what you owe on your mortgage) could go toward a down payment on a new property. Building equity is a crucial step toward your next home purchase. We can provide personalized advice on strategies to maximize your current home’s value.”

Wondering how much equity you’ve built in your current home? I’d be happy to run a free analysis for you—just reach out!

ROADBLOCK #2: I Can’t Afford the Monthly Payment

Worried about those monthly mortgage payments? High interest rates and rising costs can make mortgage payments feel daunting. But there are strategies to reduce your monthly burden.

Explore Alternative Mortgage TermsThe traditional 30-year fixed-rate mortgage isn’t the only kind of loan out there. Options like adjustable-rate mortgages (ARMs) or hybrid mortgages can offer lower initial rates.¹² ¹³ Some buyers opt for these if they plan to sell the home before the initial rate term ends or refinance down the road.

If you’re a buyer in Downers Grove or the surrounding western suburbs, this approach could be especially helpful in easing monthly costs while home values continue to appreciate.

Consider Discount PointsBuying discount points—a process also known as a permanent rate buy-down—is another great way to limit your monthly costs.¹⁴ Sellers may be willing to contribute to this as part of your contract. This is something we consider frequently for our clients in today’s competitive suburban market.

Ask About Seller Financing or an Assumable MortgageSeller Financing and Assumable Mortgages can offer unique advantages.¹⁵ While less common, these are excellent options to explore in today’s market—especially if you’re navigating a competitive situation.

Seller Financing – The seller acts as the bank, offering you potentially better terms than a traditional mortgage.Assumable Mortgage – You take over the seller’s existing mortgage with a lower interest rate than what’s currently offered by lenders.

Note that these options may or may not be possible for you depending on the seller, the home, and the type of mortgage, but they are worth exploring—and we can help.

We’re seeing increased interest in assumable mortgages around areas like Woodridge, Darien, and Lisle, where buyers are trying to make the most of older, lower-rate loans.

Co-Buy with Family or Friends Multi-generational and group home purchases are on the rise. Read my blog post “Income Properties Are Trending, But Is Landlord Life for You? ” for ideas on offsetting your mortgage with rental income and what it really means to take on landlord responsibilities.

Purchase a Home with Income PotentialFrom house hacking to short-term rentals, we can help you find a property that supports your financial goals. If you’re exploring real estate investment opportunities in Downers Grove or nearby suburbs, let’s talk about properties that offer rental potential.

ROADBLOCK #3: I Can’t Qualify for a Mortgage

Qualifying for a mortgage can be a stressful process, especially if you have previously faced financial challenges. But you might be pleasantly surprised—there’s a lot you can do to improve your chances of success.

Boost Your Credit ScoreImproving your credit score takes time but can lead to more loan options and better rates.¹⁷ If you’re unsure where to start, I can connect you with trusted local lenders and credit specialists in the Downers Grove area.

Lower Your Debt-to-Income RatioThis simple ratio affects whether you can afford the loan you want.¹⁸ Budgeting and reducing debt can boost your qualifying power. This is often an important part of the conversation when I meet with buyers—especially those planning to buy and sell at the same time. For more helpful tips, check out my blog on “9 Tips for Buying and Selling Your Home at the Same Time. “

Apply for an FHA LoanFHA loans offer flexibility to buyers with modest credit or savings.¹⁹ They have specific guidelines, but they can be a strong option for first-time homebuyers in Downers Grove, Woodridge, or Bolingbrook looking for an affordable entry point into the market. I can walk you through the process.

Consider Getting a Co-SignerA co-signer can strengthen your application if your income or credit needs support. This is something worth discussing if you’re buying with a partner or family member, especially in higher-priced communities like Hinsdale or Clarendon Hills.

ROADBLOCK #4: I Can’t Find a Home in My Price Range

Feeling frustrated by the lack of affordable homes on the market? Unfortunately, this is a common problem.²⁰ But with a little flexibility and guidance, it’s possible to find a great property to fit most budgets.

Expand Your Home SearchYou may need to search outside your target area. In many markets, home prices vary drastically within the span of miles.²¹ Being open to exploring alternative neighborhoods or those farther from town can open up surprising possibilities. In the Downers Grove area, communities like Woodridge, Lisle, or Westmont often offer similar features at a more accessible price point. As local market experts, we can help you discover hidden gems and up-and-coming neighborhoods. Reach out for a complimentary consultation.

Revisit Your Must-HavesTake a close look at your “must-have” list. Are there any features you can compromise on to expand your options and find a more affordable property? For example, do you really need two bathrooms, or could you settle for a single bathroom with space to add a second one in the future? These types of compromises can sometimes shave tens of thousands off your purchase price. We’re happy to offer our thoughts on the features you’re most likely to find within your price range in markets like Downers Grove, Clarendon Hills, and surrounding areas.

Consider Fixer-UppersLooking to cut purchase costs? Don’t shy away from homes that need a little TLC.²² Fixer-uppers usually come with a lower price tag, and you can personalize the renovations to your taste. Just be sure to factor in the cost of repairs and renovations when determining your budget—and to be realistic about your own home repair skills! If you’re open to this route, read my blog on “7 Weekend Projects to Boost Your Downers Grove Property Value ” for inspiration on affordable updates with great returns. If you’re interested in exploring fixer-upper opportunities, we can help you identify properties with potential and provide referrals to contractors.

ROADBLOCK #5: I’m Overwhelmed by the Process

Buying a home can feel like navigating a maze. Between searching for properties, securing financing, negotiating contracts, and handling paperwork, the process can quickly become overwhelming. But you don’t have to do it alone! We can simplify every step, helping you stay organized, informed, and confident in your decisions.

Find the Right Home Faster-The sheer number of listings on the market can be daunting, and homes that meet your criteria may not always be easy to find. Our team can:

Save you time by narrowing down homes that fit your budget, needs, and lifestyle.

Get you access to off-market and pre-listing properties that aren’t widely advertised.

Provide insights on local market trends to help you make a competitive offer.

We specialize in finding the right fit for buyers in Downers Grove, Hinsdale, Clarendon Hills, and surrounding communities—whether you’re looking for a turnkey home or something with room to grow.

Navigate Financing & Paperwork With EaseReal estate transactions involve complex contracts, legal documents, and lender requirements. One misstep could delay your purchase—or even cost you your dream home. We will:

Help you find down payment assistance or grants that you may not be aware of.

Explain mortgage options and connect you with reputable lenders.

Ensure all purchase documents are accurate and deadlines are met.

For more details on navigating financing as a buyer, check out my blog on “5 Solutions to Make Homeownership More Affordable”.

Score the Best DealMany buyers worry about overpaying for a home or getting stuck with costly repairs, but we know how to:

Use expert negotiation tactics to secure the best possible price.

Identify hidden costs so you aren’t caught off guard at closing.

Negotiate repairs or seller concessions to save you money.

Streamline Inspections & ClosingThe home inspection and closing process can bring last-minute surprises. We avoid these by:

Helping you interpret inspection reports and advising on necessary repairs.

Coordinating with lenders, appraisers, and title companies to keep everything on track.

Preparing you for closing day so you know exactly what to expect.

Benefit From Ongoing Support-Our relationship doesn’t end once you get the keys. We always go the extra mile to:

Recommend contractors for renovations and repairs.

Help you make strategic upgrades through complimentary real estate consultations.

Provide market updates in case you want to refinance or sell later.

If you’re planning a move to or within the western suburbs of Chicago, including Downers Grove, Woodridge, or Lisle, we’d love to be your trusted resource—before, during, and long after your purchase.

The bottom line? You don’t have to navigate this process alone. When you work with us, you’ll have a trusted partner to handle the complexities, answer your questions, and ensure everything goes smoothly from start to finish.

LET’S TURN ROADBLOCKS INTO STEPPING STONES TOWARD YOUR DREAM HOME

Buying a home may come with challenges, but none of them are impossible to overcome. With the right strategies, resources, and expert guidance, you can navigate these obstacles with ease.

Whether you’re worried about saving for a down payment, qualifying for a mortgage, or finding the right home in your price range, there are solutions available to help you move forward. The key is to stay informed, explore all your options, and work with professionals who can guide you every step of the way.

Our team is here to help you find the right home, secure the best financing, and negotiate the best deal—without the stress and uncertainty of doing it all yourself. Let’s turn your homeownership dreams into reality, whether you’re buying in Downers Grove, Woodridge, or anywhere in the western suburbs. Contact us today to get started!

The above references an opinion and is for informational purposes only. It is not intended to be financial, legal, or tax advice. Consult the appropriate professionals for advice regarding your individual needs.

SOURCES:

- Bankrate – https://www.bankrate.com/mortgages/home-affordability-report/#unaffordability

- Nerdwallet – https://www.nerdwallet.com/article/mortgages/2025-home-buyer-report

- Bankrate – https://www.bankrate.com/mortgages/first-time-homebuyer-grants/#types

- Down Payment Resource – https://downpaymentresource.com/

- Bankrate – https://www.bankrate.com/mortgages/types-of-mortgages/#government-backed

- Bankrate – https://www.bankrate.com/mortgages/understanding-va-loans/

- Bankrate – https://www.bankrate.com/mortgages/what-is-a-usda-loan/

- National Association of Realtors – https://www.nar.realtor/research-and-statistics/research-reports/highlights-from-the-profile-of-home-buyers-and-sellers

- Business Insider – https://www.businessinsider.com/boomers-not-waiting-pass-inheritance-wealth-transfer-millennials-need-it-2024-7

- Experian – https://www.experian.com/blogs/ask-experian/down-payment-gift-rules/

- Bankrate – https://www.bankrate.com/home-equity/homeowner-equity-data-and-statistics/

- Nerdwallet – https://www.nerdwallet.com/article/mortgages/adjustable-rate-mortgage-arm

- Lending Tree – https://www.lendingtree.com/home/mortgage/what-is-a-hybrid-mortgage/

- Investopedia – https://www.investopedia.com/terms/d/discountpoints.asp

- Lending Tree – https://www.lendingtree.com/home/mortgage/what-to-know-about-owner-financing/

- National Association of Realtors – https://www.nar.realtor/blogs/economists-outlook/home-for-the-holidays-the-rise-of-multi-generational-home-buying

- Consumer Financial Protection Bureau – https://www.consumerfinance.gov/consumer-tools/credit-reports-and-scores/

- Nerdwallet – https://www.nerdwallet.com/article/mortgages/debt-income-ratio-mortgage

- Bankrate – https://www.bankrate.com/mortgages/what-is-an-fha-loan/#requirements

- Bankrate – https://www.bankrate.com/real-estate/low-inventory-housing-shortage/

- Realtor – https://www.realtor.com/advice/buy/priced-out-of-dream-neighborhood-cheaper-alternative/

- This Old House – https://www.thisoldhouse.com/buying/21017198/buying-a-fixer-upper-house